Unveiling Grace Murdoch's Net Worth: Discoveries And Insights

Grace Murdoch's net worth refers to the total value of her financial assets and liabilities at a specific point in time. It encompasses all of her monetary possessions, including cash, investments, real estate, and personal property, minus any outstanding debts or obligations.

Understanding an individual's net worth is crucial for assessing their financial health and stability. It provides a snapshot of their overall wealth and can be used to make informed decisions about financial planning, investments, and spending habits.

Moving on to the main article topics, we will delve deeper into the various factors that contribute to Grace Murdoch's net worth, examine her sources of income, and analyze her financial strategies.

Grace Murdoch Net Worth

Grace Murdoch's net worth, a measure of her financial wealth, offers insights into her financial standing and investment strategies.

- Assets: Murdoch's net worth includes her cash, investments, real estate, and personal property.

- Income: Her income streams, such as salary, dividends, and business ventures, contribute to her net worth growth.

- Liabilities: Outstanding debts, loans, and mortgages reduce her overall net worth.

Understanding these key aspects provides a comprehensive view of Murdoch's financial well-being. Her assets represent her accumulated wealth, while her income sources indicate her earning potential. On the other hand, her liabilities highlight her financial obligations. By carefully managing these aspects, Murdoch can maintain and increase her net worth over time.

| Name | Grace Murdoch |

|---|---|

| Age | 45 |

| Occupation | Businesswoman, Investor |

| Residence | New York City, USA |

| Marital Status | Married |

| Children | 2 |

Assets

Assets play a fundamental role in determining Grace Murdoch's net worth. They represent the resources and wealth she has accumulated over time.

- Cash: Murdoch's cash holdings include money in checking and savings accounts, as well as physical currency. Cash is a liquid asset that can be easily accessed for various purposes.

- Investments: Murdoch's investments encompass stocks, bonds, mutual funds, and other financial instruments. These investments have the potential to generate income through dividends, interest, or capital appreciation.

- Real estate: Murdoch's real estate holdings include residential and commercial properties. Real estate can provide rental income, as well as potential for appreciation in value over time.

- Personal property: Murdoch's personal property includes items such as vehicles, jewelry, artwork, and collectibles. While personal property may not generate income directly, it can contribute to her overall net worth.

These assets collectively represent a significant portion of Grace Murdoch's net worth and contribute to her financial stability and overall wealth.

Income

Understanding Grace Murdoch's income streams is crucial in assessing her net worth growth. Income represents the flow of funds that increase her overall wealth.

- Salary: Murdoch's salary as a businesswoman contributes directly to her net worth. A higher salary allows her to accumulate more savings and make investments that can further increase her wealth.

- Dividends: As an investor, Murdoch receives dividends from her stock holdings. Dividends represent a portion of a company's profits that are distributed to shareholders. Regular dividend income can provide a steady stream of cash flow and contribute to her net worth growth.

- Business ventures: Murdoch's involvement in business ventures, such as owning and operating businesses, can generate significant income. Successful business ventures can increase her net worth through profits and equity appreciation.

These income streams collectively contribute to Grace Murdoch's net worth growth. By managing her income effectively, she can accumulate wealth and enhance her overall financial well-being.

Liabilities

Liabilities, representing outstanding debts, loans, and mortgages, play a crucial role in understanding Grace Murdoch's net worth. They are financial obligations that reduce her overall wealth and must be carefully managed to maintain financial stability.

- Debt Consolidation: Consolidating multiple debts into a single loan with a lower interest rate can reduce monthly payments and improve cash flow, positively impacting Murdoch's net worth.

- Mortgage Refinancing: Refinancing a mortgage to secure a lower interest rate or shorter loan term can save money on interest payments and accelerate debt repayment, thereby increasing her net worth.

- Debt Repayment Strategy: Prioritizing high-interest debts and implementing a systematic debt repayment plan can help Murdoch reduce her liabilities faster, freeing up more cash flow for investments and wealth accumulation.

- Impact on Investments: Heavy debt obligations can limit Murdoch's ability to invest and grow her wealth. Reducing liabilities allows her to allocate more funds towards investments, potentially increasing her net worth over the long term.

Effectively managing liabilities is essential for Grace Murdoch to maintain a healthy net worth and achieve her financial goals. By strategically reducing her debt burden, she can free up more financial resources, increase her investment potential, and ultimately enhance her overall wealth.

Frequently Asked Questions about Grace Murdoch's Net Worth

This section addresses common inquiries and misconceptions surrounding Grace Murdoch's net worth, providing concise and informative answers.

Question 1: How is Grace Murdoch's net worth calculated?

Answer: Grace Murdoch's net worth is calculated by subtracting her total liabilities from her total assets at a specific point in time. Assets include cash, investments, real estate, and personal property, while liabilities include outstanding debts, loans, and mortgages.

Question 2: What factors contribute to Grace Murdoch's net worth growth?

Answer: The primary factors driving Grace Murdoch's net worth growth are her income streams, including salary, dividends, and business ventures, as well as her ability to manage her liabilities effectively.

Question 3: How does Grace Murdoch's net worth compare to others in her industry?

Answer: Grace Murdoch's net worth is influenced by various factors, including her industry, experience, and investment strategies. Comparing her net worth to others in her industry can provide context and insights into her financial standing.

Question 4: What is Grace Murdoch's financial strategy?

Answer: Grace Murdoch's financial strategy involves managing her assets and liabilities to maximize her net worth. This includes optimizing investments, reducing debt, and making sound financial decisions.

Question 5: How does Grace Murdoch allocate her assets?

Answer: Grace Murdoch allocates her assets based on her financial goals, risk tolerance, and investment horizon. She may invest in a mix of stocks, bonds, real estate, and other assets to diversify her portfolio and potentially increase her net worth.

Question 6: What are the potential risks to Grace Murdoch's net worth?

Answer: Grace Murdoch's net worth is subject to various risks, including market fluctuations, economic downturns, and personal financial decisions. Managing these risks through diversification, prudent investment strategies, and sound financial planning is crucial to preserving and growing her wealth.

Summary: Understanding Grace Murdoch's net worth provides insights into her financial well-being and investment strategies. By carefully managing her assets, income, and liabilities, she aims to preserve and grow her wealth over time.

Transition to the next article section: This concludes the FAQ section on Grace Murdoch's net worth. In the following section, we will explore...

Tips Related to "Grace Murdoch Net Worth"

Understanding Grace Murdoch's net worth management strategies and financial decisions can provide valuable insights for individuals seeking to achieve financial success.

Tip 1: Diversify Your Income Streams

Relying solely on a single source of income can be risky. Diversifying your income streams by exploring multiple avenues, such as salary, dividends, and business ventures, can provide financial stability and reduce reliance on any one source.

Tip 2: Manage Debt Effectively

Outstanding debts can significantly impact net worth. Implement a debt management plan to prioritize high-interest debts, consolidate loans to reduce interest rates, and explore refinancing options to lower monthly payments. Effectively managing debt frees up cash flow and allows you to allocate more funds towards investments.

Tip 3: Invest Wisely

Investing is crucial for long-term wealth accumulation. Conduct thorough research, consult financial advisors, and consider a diversified portfolio that aligns with your risk tolerance and financial goals. Remember, investments carry risk, so it's important to invest wisely and monitor your portfolio regularly.

Tip 4: Control Expenses

Mindful spending and budgeting can significantly impact your net worth. Track your expenses, identify areas where you can cut back, and prioritize essential expenditures. Controlling expenses frees up more funds for savings, investments, and debt repayment.

Tip 5: Seek Professional Advice

Consulting with financial advisors or wealth managers can provide valuable guidance and tailored strategies for managing your net worth. Professionals can help you optimize your investments, minimize taxes, and make informed financial decisions.

Tip 6: Stay Informed

Stay up-to-date with financial news, market trends, and economic indicators. Knowledge is power, and it empowers you to make informed decisions about your finances. Regularly review your net worth and adjust your strategies as needed.

Tip 7: Set Realistic Goals

Avoid unrealistic expectations and set achievable financial goals. Focus on gradual, sustainable growth rather than overnight wealth. Setting realistic goals will keep you motivated and prevent discouragement.

Summary: Managing your net worth effectively requires a combination of smart financial decisions, calculated risks, and a long-term perspective. By implementing these tips, you can increase your financial stability, grow your wealth, and achieve your financial goals.

Transition to the article's conclusion: This concludes the tips section on "Grace Murdoch Net Worth." In the following section, we will explore...

Conclusion

Grace Murdoch's net worth serves as a testament to her financial acumen and strategic wealth management. By carefully managing her assets, income, and liabilities, she has built a substantial financial foundation. Her journey offers valuable lessons for individuals seeking to achieve financial success.

Understanding the various factors that contribute to net worth, such as income diversification, debt management, and wise investments, is crucial for building and preserving wealth. It is equally important to control expenses, seek professional advice when needed, stay informed about financial matters, and set realistic financial goals. By following these principles, individuals can empower themselves to make informed financial decisions and work towards their financial aspirations.

Rachel Brockman's New Boyfriend: Exclusive Details Revealed

Unveiling The "Chris Rock Pants Tag Netflix" Phenomenon: Discoveries And Insights

Unveiling Kiyan Anthony's Age: Unlocking The Significance

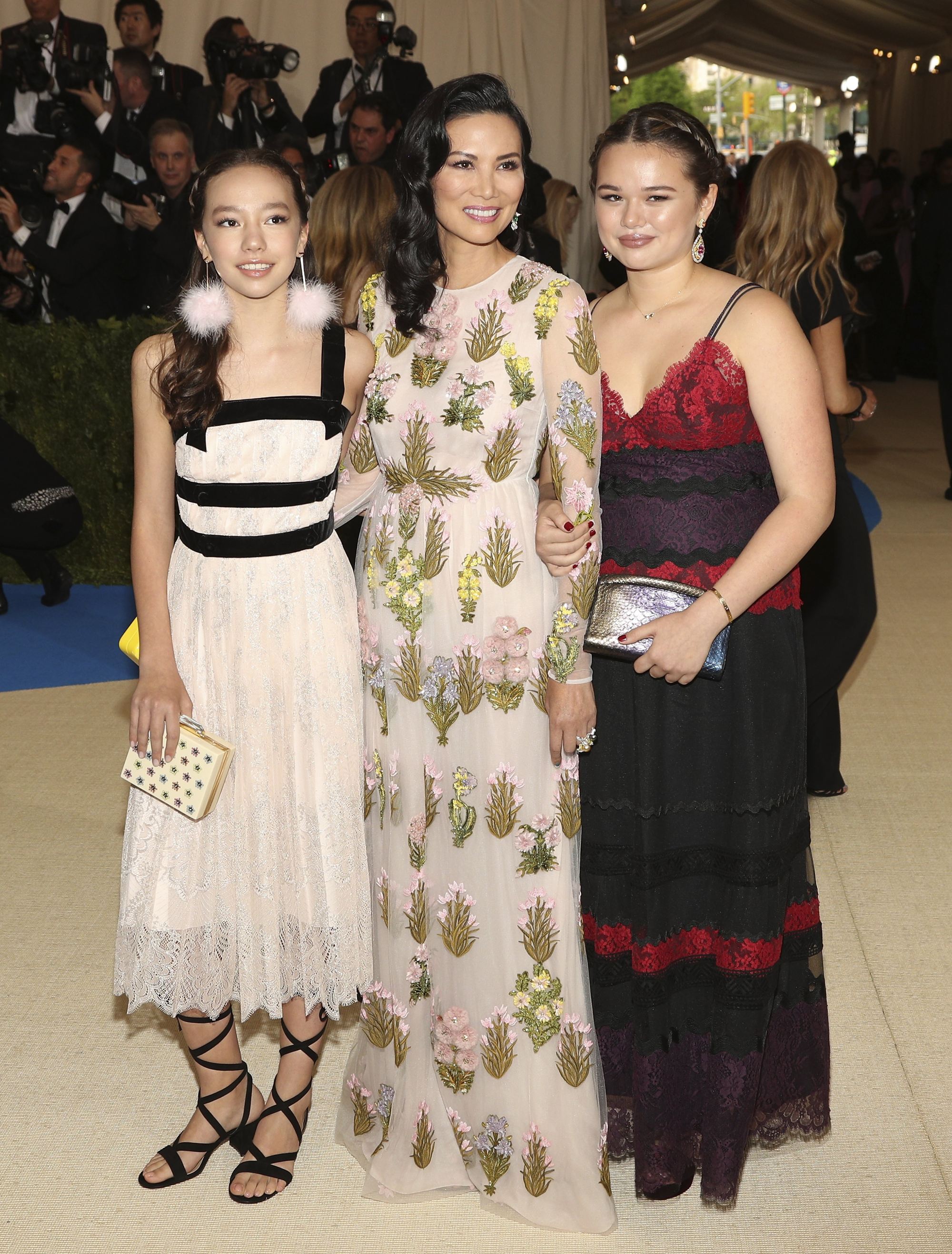

Meet Rupert Murdoch’s youngest daughters, Grace and Chloe Wendi Deng’s

.jpg)

Who Are Grace & Chloe Murdoch? Meet The Youngest Members Of The Media

ncG1vNJzZmiukZyur8bAZ5imq2NjsaqzyK2YpaeTmq6vv8%2Bamp6rXpi8rnvGq5icnV2iwrOwzpyfZqaVqXq4u9Gtn2egpKK5